Car Finance Vs Bank Loan

There is little risk from the lenders perspective when they know the future value of the car. Banks are direct lenders and getting pre-approved for a car loan from a bank puts you one step ahead of a dealer you know what your interest rate is and can compare that number to what other lenders can offer if you choose to rate shop.

Anyone With A Car Can Get An Auto Title Loan No Background Checks Or Credit App Car Title Car Loans Loan

You can also use a bank loan if you purchase the car from a private seller.

. A personal loan can be secured against something of value or more. A direct lender includes a bank credit union or finance company. In general youll get preapproved for a loan before you ever set foot in the dealership.

Financing a Used Car. Car loans are something you must specifically apply for with a bank or credit union. Auto loans are offered through two different sources.

You have ruled out leasing so you are down to two options. With a car loan you apply directly with one lender and can get a rate quote before you submit your application. You also could explore auto loans offered by online sources although you may not be able to get full details about a loan offer until you have a specific car picked out.

One of the big advantages that you could get by working with a bank for your auto loan is being pre-approved before you start shopping. The main difference between dealership financing and auto loans is in how you apply. Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Worry Free.

Car loans allow you to finance your car by allowing you to pay for it in more amenable terms usually on an installment basis. Bank loans are good at most franchise dealers and some independent ones. Although they vary from bank to bank eligibility requirements are generally stricter than with dealers which means more criteria are to be met before getting approved for a loan.

Check our financing tips and find cars for sale that fit your budget. Since a car loan is deemed a lower risk you should get a lower interest rate and financing for a car is also easier to obtain than a personal loan. Its pretty easy to see how too as interest rates between manufacturer-backed PCP deals used car finance schemes and bank.

Heres a look at the pros and cons of cash versus financing and what you should consider. A bank loan provides you with the money to buy the car outright and then pay off the loan so. Unlike dealers that offer negotiable interest rates a banks offer is final.

However the car isnt really. Banks and dealers offer lower interest rates on new cars. When you apply for a bank loan youll need to prepare the documentation yourself.

If youre on the market for a new car but are still confused on what auto loan financing option is best for you we are here to help you understand the pros and cons of both. You choose the lender for your car loan. Buying a car outright or getting an auto loan.

A PCP deal is typically only an option on higher priced cars worth more than 10000 but PCP plans offer lower monthly payments and more options at the end of the deal - buy the car trade it in and start a new PCP deal or hand back the car. If you have a strong relationship with your bank you may be able to get pre-approved for a car loan. Car loans are available directly from lenders while dealer finance is arranged by the dealership that sells cars.

Online lenders may have different rules and restrictions than banks. Car finance through a dealership usually leads the dealership to selling the loan to a finance company after its initial processing. Motiv There are two main types of car finance hire purchase HP and personal contract purchase PCP.

PCP Vs Bank Loan PCP Personal Contract Purchase finance lends you the car while you pay off the value of its depreciation over the term of your agreement. Taking out the cheapest option can typically save people thousands of pounds over an average three-year deal. In other words if you dont make your payments the finance house takes the car.

A bank loan are. If you opt for vehicle finance it is secured against the car you are buying. With financing options are presented to you at a dealership.

Buying a car with a personal loan involves borrowing the funds from a bank building society or other lender so the dealer has no involvement in financing and you effectively become a cash buyer. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval. A personal loan can be used for many different purposes whereas a car loan is strictly for the purpose of purchasing a vehicle.

Among car buyers in the US 43 opt to finance them while 36 buy them outright according to data from Statistic Brain the remaining 21 lease. The dealer is keeping the extra. Click Now Apply Online.

The dealership or a direct lender. Bank financing involves going directly to a bank or credit union to get a car loan. The key differences between dealer car finance vs.

Banks and dealer financing. By doing this you will be able to know if there are any credit problems that you will have to deal with before you go into the dealership. The reasoning is that it is much easier to determine the resale value of a new car because of the general understanding of the new car depreciation rate.

In general youll get preapproved for a loan before you ever set foot in the dealership. There are two sources for auto loans. When you get pre-approved you know that you are going to be able to.

Pros Competitive rates Personalized service. Ad The Comfort Of a Simple Auto Loans Is Priceless. If you borrow through your dealer theyll typically send your details to multiple lenders to see where you qualify.

Choosing between a car finance scheme and a good old fashioned bank loan is a popular dilemma among modern car buyers. The difference between financing a car and getting a car loan is that financing packages are varied and available at the dealership or sales lot. Youll be paying 7 percent interest on the loan but the dealer may have gotten a quote for 65 percent.

Compare Rates Save Money. Read Expert Reviews Compare The Best Auto Loans Options.

Idbi Bank Offers Car Loans With Attractive Interest Rates For Upto 7 Years Calculate Your Eligibility And Get A Free Emi Quote Car Loans Car Finance Finance

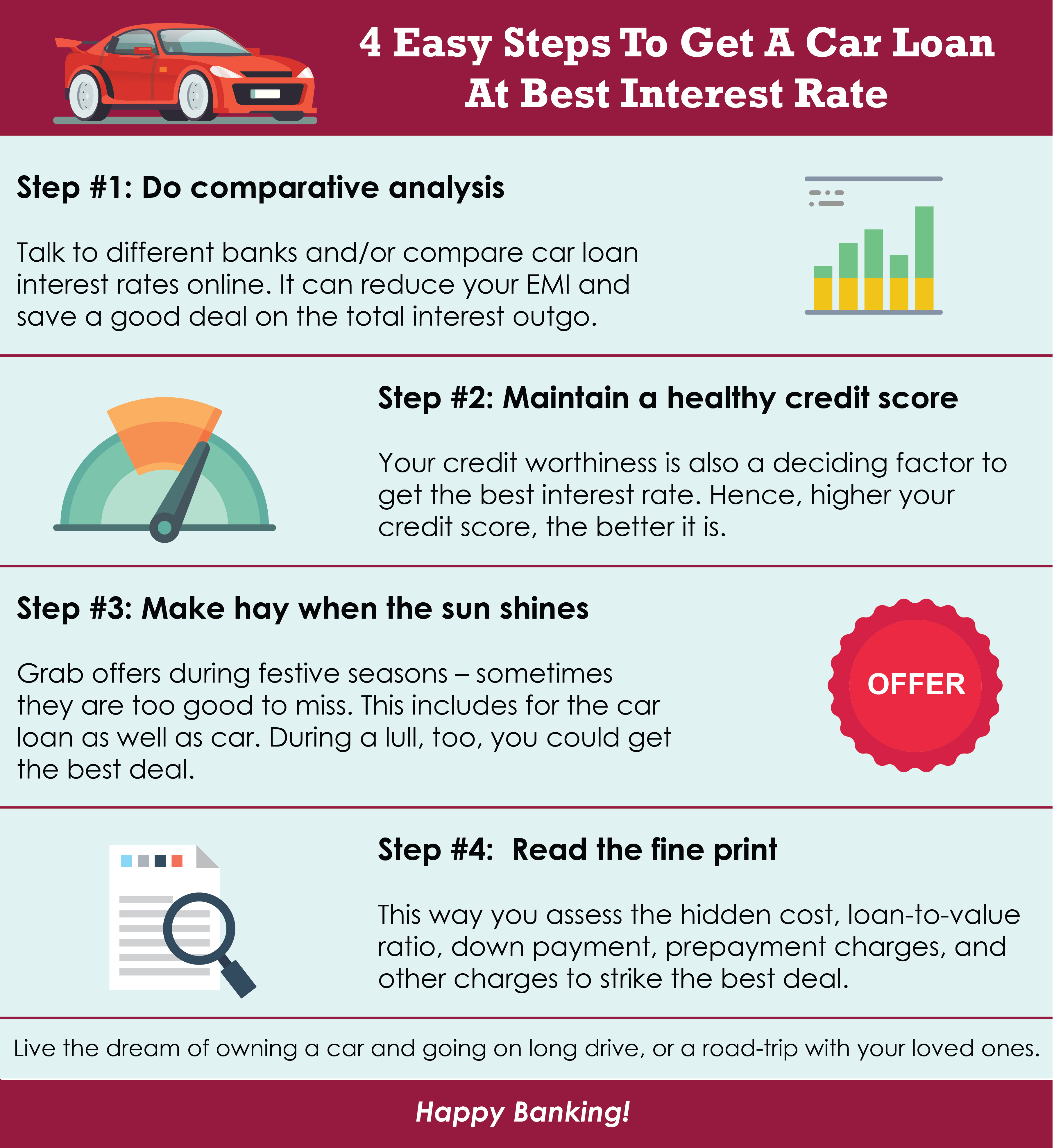

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

Sit Back On The Couch And Relax As Now Cars Are Achievable At Even Dismal Credit Conditions Car Loans Car Finance Finance Loans

No comments for "Car Finance Vs Bank Loan"

Post a Comment